Investors, Analysts and Traders have different way of calculating the overall market condition. Everyone tries to analyze market in their own way so they can be safe. Many people consider PE Ratio of over all market very seriously and yes its really crucial ratio which one should look for.

But do you know how Warren Buffett evaluates the market??

Warren Buffett looks at Market Cap-to-GNP ratio. Around 15 years back in an interview with Fortune Magazine he revealed that the Market Cap-to-GNP ratio is his favorite indicator to determine whether the stock market is cheap or expensive. By quoting this, Buffett implies the ratio to be: Market Cap of the entire stock market divided by the total Gross National Product of the country.

Many people use the Market Cap-to-GDP ratio in place of Market Cap-to-GNP ratio because Gross Domestic Product is updated a month before GNP; the result is roughly the same. It’s a very logical conclusion that there should be a relationship between the economic output of a country and their valuation. And investors should take decision whether they should invest or not after looking at this ratio.

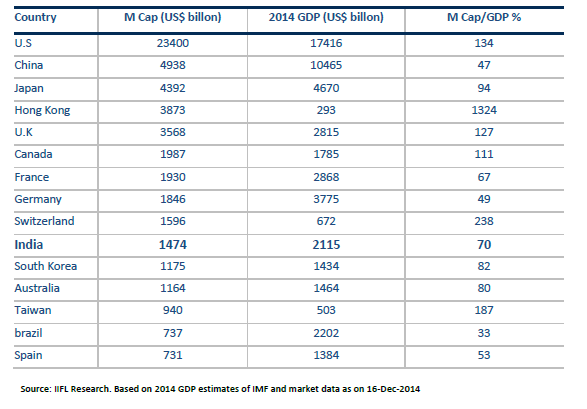

India’s Market Cap in Global Context: To understand the global scenario of this ratio, refer to the table below. India’s Market Cap to GDP ratio stands at 70% whereas the global averages is 82%. So, one can surely estimate how much scope India has as compared to other nations. From the below table we can infer that India is placed at very reasonable ratio as compared to the global scenario:

If we have a belief that our GDP will improve in coming years by the efforts of the Indian Government then the Market Cap of India will also improve at a faster rate as more investments will flow in our country. Surely by looking at above table we can say that Brazil, China, Germany and Spain are also providing better opportunities as their Market Cap to GDP ratio is towards lower side but we need to consider that what kind of scope of improvement in GDP is there. Taking into account the efforts of our Government, it is believed that we will be the fastest growing country in an emerging market. So, we can guesstimate that what kind of improvement in Market Cap is possible.

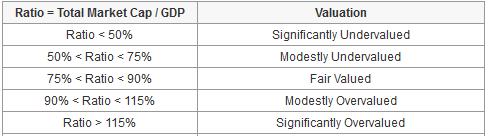

Warren Buffett’s Market Indicators: Now we can clearly state that what Market Cap to GDP ratio stands for different countries, as can be seen from the table above. The next question that arises immediately, what ratio is justified for the future growth or what valuation they carry. To understand the same based on these historical valuations, normally market valuation is divided into five zones:

By seeing this valuation parameter for different range of Market Cap to GDP ratio we can clearly say that our market is Modestly Undervalued where as the US market is Significantly Overvalued. Surely lot of scope lies in the Indian Market but lot of efforts is required for it. From the above table we can clearly say that the Market Cap to GDP ratio should lie between 75 to 90% for it to be Fairly Valued.

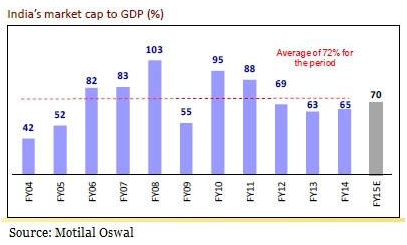

Historical Chart of Market cap to GDP Ratio of India: According to me, this is one such crucial chart because it depicts where we are from last 10 years and what kind of scope we have in future. Refer to the chart below, we can clearly see that our average ratio is 72% and currently we are at 70% which means we are around our historical performance. If we talk about past 10 years’ records, five times we were above our historical average. In FY07 & FY08 our Market Cap to GDP ratio was at 83% & 103% respectively, which indicate we were at overvalued state. In those 2 years most of the countries were in overvalued state and if you remember we faced greatest recession of our period at that time. But at the current level market has great potential to go in the 80-90 range, where market can grow.

Bottom line: Market Cap to GDP ratio plays very important role in determining the overall market condition, as it shows the direct relation with the GDP of the country. So, if an investor would like to watch the overall condition he must check Market Cap to GDP ratio along with other factors. But a Value Investors does not invest in the market; they buy great companies at good prices which has potential to grow in any market. While it’s getting harder and harder to find these kind of companies but performing an in-depth research will enable you to take action when opportunities arise. So, keep your eyes open for the better opportunities around and grab it.

If you have something to add, Please post your thoughts in comments. I would love to hear from you.

Happy Investing!!

My spouse aand I absolutely love your blog and find almost

all of your post’s to be precisely what I’m looking for.

Do you offer guest writers to write content in your case?

I wouldn’t mind publishing a post or elaborating on many of the subjects you write

about here. Again, awesom site!

Hi, Thanks for appreciation.

And for the guest writer surely i can look forward for that. Please connect with me at vikas@finaacle.com So, we can discuss the same in detail.

Cheers!!

An intriguing discussion is worth comment. I do believe that

you should publish more on this subject, it might not be a taboo subject

but usually folks don’t speak about such subjects.

To the next! Cheers!!

Hi, Thanks for your comment. Would surely take your feedback and write on this subject regularly.

Cheers!!

Wow that was unusual. I just wrote an very long comment but after I clicked submit my comment didn’t show up.

Grrrr… well I’m not writing all that over again. Regardless, just wanted to say fantastic blog!

Dear Anja,

Sorry if something such happen. I have kept the spam filter so it need my approval before it appears on the website.

And thanks for your appreciation.

Your means of describing all in this article is genuinely pleasant,

Thank you.

Keep on working, great job!

Thanks!!

You’re so cool! I truly do not think I have got read anything similar to this before.

So good to locate somebody else with a bit of unique ideas on this issue.

Seriously.. thank you for starting this up. This website is something that’s needed on the internet, someone with a bit of originality!

Thanks for your nice words.

Hi to all, how is the whole thing, I think every one is getting more from this website, and your views are nice for

new viewers.

Thanks for your nice words.

Pretty nice post. I simply stumbled upon your blog and wished to mention that I have

truly enjoyed surfing around your blog posts.

Whatever the case I’ll be subscribing inside your rss feed and I hope you write again soon!

Thanks for your nice words.

This is my first time pay a visit at here and i am in fact pleassant to read

all at one place.

Thanks for your nice words.

Really good information. Lucky me I discovered your blog by accident (stumbleupon).

I have book marked it for later!

Thanks for your nice words.

Greetings! Very useful advice in this article!

This is the little changes that make the most significant changes.

Thanks a whole lot for sharing!

Yes, small changes in the way we look at the things can make bigger impact. Hope it would be helpful in your investing approach.

Love it and fast shipping to thank you