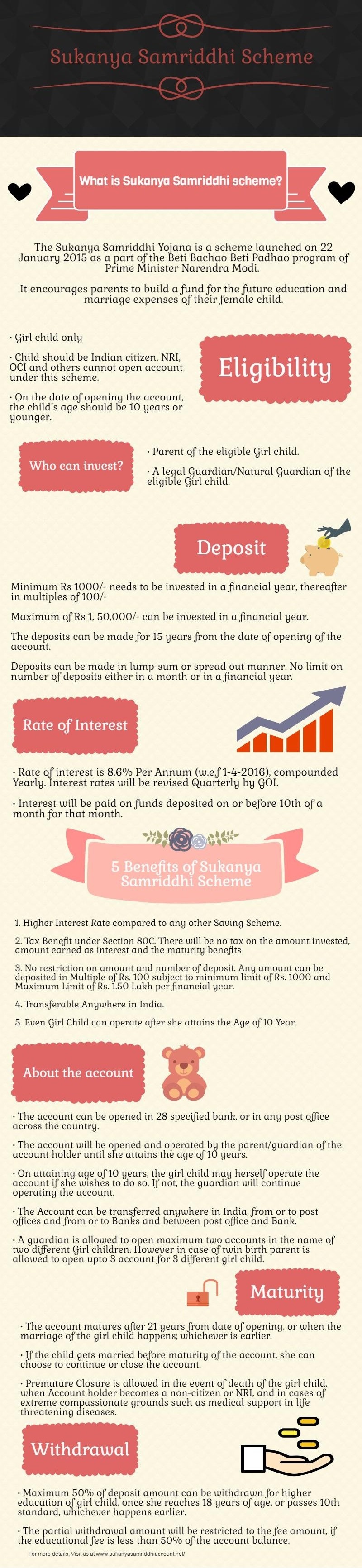

Sukanya Samriddhi Scheme is a saving program set up in 2015 under the Beti Bachao Beti Padhao program of Prime Minister Narendra Modi. The vital goal of this strategy is to promote higher education and learning amongst girls by suggesting the parents to save a portion of their income for the much better and assured future of their girl child.

Sukanya Samriddhi Scheme can be opened for a girl child who is an Indian Citizen as well as 10 years or even younger in age. The parents or the legal guardian of the girl child can open up this account, but in the name of the eligible Girl child. The account can be opened in 28 chosen bank institutions or any post office across the country and can be easily moved anyplace in India.

This scheme is a long term investment program where the parent/guardian needs to deposit for 15 years from the date of opening the account. The deposit sum can be anything from Rs.1000 p.a to Rs. 1,50,000 p.a. with no restrictions on the sum or the number of deposit. The scheme gives an Interest rate of 8.6% p.a (w.e.f 1-4-2016), which is greater than any other saving scheme in India. Be cautious! These interest rates shall be revised every quarter.

The Maturity of this scheme is 21 yrs from the time of opening the account and the sum after maturity will be paid to the Girl child. Partial withdrawal of 50% of the sum for the higher education is acceptable only when the girl child reaches 18 years or passes 10th standard whichever is earlier. In any other case, the Scheme prohibits the account holder from making any other early withdrawals.

Sukanya Samriddhi Scheme offers Income tax Benefit under Section 80C. There will be no taxes on the sum invested; sum received as interest and the maturity benefits.