We all seem to have heard of this 80-20 rule somewhere in our life and it applies in many cases. If you have heard of 80-20 rule and would like to know how it applies to the loss making CPSEs (Central Public Sector Enterprises) companies then please read the full article. It will broaden your perspective about this rule and how any one can use this in different situation.

You might be thinking that this rule will introduce you to a complicated maths formula which I believe you will hate. So, I will try to keep it simple and understandable to you.

Lets first understand the definition of 80-20 rule; according to Wikipedia the definition is:

The principle was suggested by management thinker Joseph M. Juran. It was named after the Italian economist Vilfredo Pareto, who observed that 80% of income in Italy was received by 20% of the Italian population. The assumption is that most of the results in any situation are determined by a small number of causes.

Now lets understand this definition in the language which is simple for you and me.

“20% of work delivers your 80% happiness and output.”

In the financial terms even this rules apply. Your 80% of income is produced by your 20% of activities. In your companies also 80% of the revenue is generated by 20% of products. Surely, this is not hard and fast rule but this can be applied in different ways like suppose in your company 80% revenue is generated by 20% of employee. The ratio can differ but it might be somewhat like 80-20.

Now lets try to apply this rule to Value Investor: In share market you hear a lot of news, every minute, every hour and every day. Some things happen in any part of any country and these news channel will surely try to connect it with economy from different perspective; that’s their role so I am not blaming them. But if you observe them carefully you will find that for a value investor in the long term only 20% of these news will might deliver his or her 80% results. So, as a value investor you must focus on those 20% of news which would be really helpful to you.

Lets see the application of this 80-20 rule to our beloved loss making CPSEs companies. These companies are making so much loss even then we are trying to make them survive with poor management and bad technique. Its human philosophy to stick with bad and waste lot of time & money.

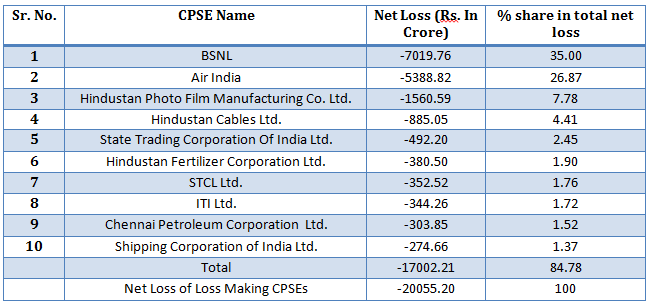

Have a look on the below list of top 10 loss making CPSEs companies:

These 10 companies are sucking our hard earned money which we pay as tax to government. Total loss of these 10 companies is Rs. 17,002 crore.

If you observe then 72% of loss from these 10 companies is generated by only 2 companies which is 20%. These 2 companies are BSNL and Air India. If we really sell them to private player as our government already tried every thing to revive them but failed then at least we can save around Rs. 12407 crore every year. And then we can put this money in betterment of other CPSE companies which are just on the verge of the turnaround. But our 80% of focus in CPSE remain to major loss making companies to make them turnaround and in that case we put more money in them. We need to understand that some companies cant be turned around and why we need to make them survive if you can sell them to private players and focus on good companies which can generate more revenue for government.

I hope government one day will realize or read this article (if my luck works :D) that 80-20 rule is applicable in their loss making CPSE companies. Then only they will take corrective action which is must for survival of these CPSE companies. Otherwise many other companies will also have to suffer due to these 2 companies.

The message is simple:

We all need to focus on those activities that produce best outcomes.

Why don’t government close these two companies?? why they are sticking with them??

I guess its a lot of political pressure. Also these 2 companies employee lot of people so if Govt closes them then it will big set back for the govt. and the sector. It will create a bad image in front of every one specially those companies working in these sector or wish to invest in India in these sector. So, Govt. is just trying to find out new solution but those solution are not easy to implement.