You are earning a good salary every month and you are living your life with this monthly income. Living in good flat; having car; going for shopping, movie and enjoying your life with family. Usually we enjoy all this till December after that we realize that we need to put some money in tax saving scheme otherwise we need to pay big amount of tax and this puts a lot of pressure on the forthcoming 3-4 months.

Don’t you think it would be better to start investing in tax saving schemes from the beginning of the financial year and face less pressure at the end. People usually believe that tax saving instruments can’t give good return and they are just meant to save tax as they usually invest in those old traditional options to get very minimum return in a long term period because they believe its the safest investment one can have.

The different tax saving tool in India are ELSS, ULIP, PPF, NPS, NSC etc. I personally believe to invest in Equity Linked Saving Scheme (ELSS), it can give you tax benefit with very good return in the long run. ELSS can also be used for wealth generation as it invests heavily in Equities to ensure the desired long term yields.

Lets have a look on the features of ELSS:

1.) Lock in period is only 3 years, which is least among all tax saving instruments.

2.) You invest in equities indirectly and these funds are managed by professionals.Also, they have huge amount of investment so risk gets divided up to a large extent which reduces the pressure on individual investment.

3.) Long term capital gains are tax free. The dividends earned from an ELSS scheme are also tax free. In fact long term gain from equity is tax free if you hold any investment for more than 1 year.

4.) As per U/S 80C of Income Tax Act, investors can save tax on an amount up to INR 1,50,000 and you can invest this full amount in ELSS as it will give you better return with lesser time period.

5.) You can invest through SIP (Systematic Investment Plan) in ELSS.

You might be thinking that other tax saving tools also have certain features and benefits which might be better than ELSS. Then why I am emphasizing you on ELSS.

Being frank, I am not forcing you to go with ELSS only. It depends on individual and I personally like to go with the tax saving tool which can give me better return in lesser time.

So, why not we see how other tax saving tools perform in compare to ELSS:

1.) ELSS Vs Public Provident Fund (PPF): PPF is one of the oldest tool of tax saving in India. Most of the people invest their some part of tax saving into it every year. One can save tax upto INR 1,50,000 by investing in PPF u/s 80C of the Income Tax Act.

The lock in period of the scheme is as long as fifteen years and can be extended in block of five years after maturity. One can withdraw partial amount after completion of 7th year. Usually in PPF money is invested in both government and corporate bonds and securities and is a debt scheme.

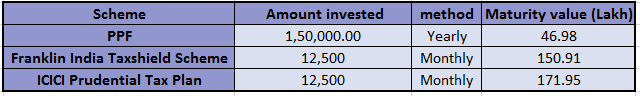

Returns Comparison of PPF and ELSS: Suppose one person invests INR 1,50,000 in PPF every year for 15 years then maturity value will be INR 46.98 Lakh. The other person invests INR 12,500 per month for next 15 years or 180 months then then the amount will be more than INR 1.5 crore. One can see the below table; here we took 2 ELSS schemes which are old and performing really good from their inception.

2.) ELSS Vs Tax Saving Fixed Deposit: Tax saving fixed deposit comes with 5 year lock in period. Principal is tax free if you invest for the 5 years but interest earned is taxable; one can save tax on interest if he or she reinvest it. The interest amount upto 10,000 INR is non-taxable other wise 10% TDS is applicable.

ELSS in comparison with it wins in every aspect. The lock in period for ELSS is only three years and the long term capital gains and dividends are totally tax free.

3.) ELSS vs United Link Insurance plans (ULIPs): ULIP earned lot of bad name in past years due to lack of transparency along with the high cost. The overhead costs such as the premium allocation charge and the policy administration charges in ULIPs often eat up all the returns.

ULIP has a lock in period of three to five years. Huge surrender charges are levied if the investment is withdrawn before five years. No such charges are applicable for ELSS except for a minor annual management fee deducted by the Asset Management Company.

The performance of ULIP is often hampered by the overhead and administrative cost involved but in ELSS it is not applicable.

4.) ELSS Vs National Saving Certificate (NSC): NSC usually referred as a fixed income earning instrument. Its interest rates are at par with other Government tax saving instruments. NSC is compounded half yearly and the interest rates are declared annually.

The major disadvantage of NSC over ELSS is the tax treatment of interest earned. The interest earned in NSC is taxable whereas ELSS does not come with any such tax clause.

If any one is looking to save tax and earn good return then surely there is no doubt that he or she should go with ELSS. One should start Systematic Investment in the ELSS as it will reduce risk and burden on the individual of investing a lump sum amount at the end of financial year. Even the returns earned in SIP is more than lump sum.

So start investing in tax savings schemes especially through ELSS route from the beginning of the financial year. Let the saving and investing begin!

Wonderfully explained. Why is it so that ELSS must be considered for long term not short term??

Actually ELSS come with 3 year lock in period..so it in self is long term..but on the safer side ELSS should be hold for minimum 5 year time frame. It might be that you get good return in 3 years also but to be on the safer side you should hold equity for longer term.