A glimpse of Dr. Lal PathLabs:

Dr. Lal PathLabs provides a broad range diagnostic & related healthcare tests and services for use in core testing, patient diagnosis and the prevention, monitoring and treatment of disease and other health conditions. They cater to individual patients, hospitals and other healthcare providers and corporate customers.

They built a national network consisting of its National Reference Laboratory in New Delhi, 163 other clinical laboratories, 1,340 patient service centers and over 5,000 pickup points as of March 31, 2015.

Key highlights of the company:

1. Offers 3,368 diagnostic and related healthcare tests.

2. Collected 21.8 million samples from 9.9 million patients in FY 2015.

3. Centralized information technology platform fully integrates to its network and it is scalable.

Issue Details:

- Issue Open: 8th Dec’15 – 10th Dec’15

- Issue Type: Fixed Price Issue IPO

- Face Value: Equity Shares of Rs. 10

- Issue Size: Rs. 638 Crore

- Issue Price Band: Rs. 540 to 550 per share

- Minimum Shares: 20 Shares and in multiple of 20 there-of

- Minimum Amount: Rs. 10,800

- Listing: BSE and NSE

- Download Dr. Lal PathLab IPO Prospects at this link

Company’s Promoters:

The Promoters of the company are:

1. Dr. Arvind Lal;

2. Dr. Vandana Lal; and

3. Eskay House

Also Read: Common Investor Philosophy

Objectives of the IPO:

The Issue comprises the Fresh Issue and Offer for Sale:

1. Listing benefits;

2. Increase visibility & brand name;

3. For offer for sale up to 1.16 crore equity shares.

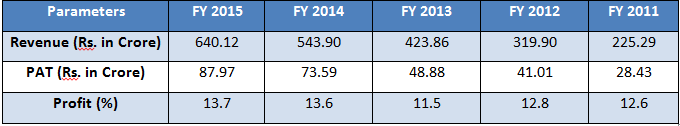

A close look on the Financials of the Company:

From the above table its clear that company is growing at good speed. Its EPS for FY 2015 is Rs. 11.57 and last 3 years average EPS is Rs. 10.2.

Reasons to Invest in Dr. Lal PathLabs IPO:

- Revenue is growing at good speed. Growth in revenue is 30% CAGR in last 5 years.

- Profit Margin is good above 13%.

- Well-positioned to leverage upon one of the fastest-growing segments of the Indian healthcare industry.

Also Read: Two Faces of Coin: Savings and Investments

Reasons to NOT to Invest in Dr. Lal PathLabs IPO:

- Revenue growth rate is decreasing continuously, it implies that the company is coming into saturation stage.

- Company has no clear plan why they are coming with the IPO. Just trying to get their previous holder to get out from the company.

- Operate in highly competitive market and their inability to cope up with them will impact the company.

Investment Strategy:

At an upper price band of Rs. 550 its P/E ratio is 47 at EPS of Rs. 11.57 whereas on 3 years average EPS of Rs. 10.2; the P/E ratio is 53.9. It implies that company is towards higher band price asking for 47 to 54 P/E ratio. As mentioned by Benjamin Graham in his best value investing book named “The Intelligent Investor“ that such kind of P/E ratio is very highly over valued for a common investor and one should never invest in such kind of shares. Hence, issue seems to be highly over priced. I would recommend NOT to subscribe to the same.

Disclaimer:

Investing in this IPO does not interest me much. The idea of enlisting positive and negative sides to investor in this articles is to create awareness and educate about this IPO. Please consult your investment adviser before you invest in such high risk investment option.