Interglobe Aviation Ltd, which runs India’s largest airline IndiGo, is seeking to raise Rs.1,272.20 Crore through its initial public offering. The company has fixed the price band for its initial share sale at Rs 700-765 and it will run on October 27-29.

A glimpse of IndiGo:

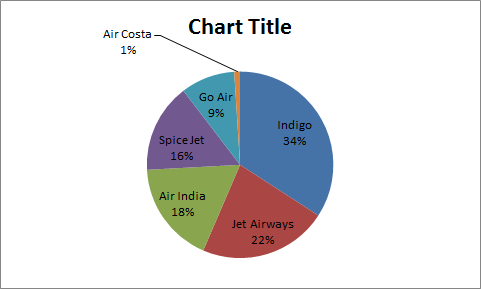

InterGlobe Aviation is the holding company of IndiGo airlines. IndiGo is largest passenger airline of India. The Gurgaon-based entity is also the largest domestic carrier by market share, they handles 33.8% of the total domestic passenger volume in India. Their strategy is to keep profit margins small and make fares cheap for the passengers, which is known as LCC (Low Cost Carrier) model. IndiGo started with only one airplane and now they have 97 planes in 2015.

Domestic Market Share of Airlines in India

Company has one joint venture with Accor Asia Pacific since 2004 to create a network of ‘Ibis’ hotels throughout India, Nepal, Sri Lanka and Bangladesh. Right now they have 10 running Ibis hotels and 9 hotels are under development. They are looking to increase room inventory to about 3500 rooms by 2017 with running 19 hotels.

Issue Details:

- Issue Open: 27th Oct’15 – 29th Oct’15

- Issue Type: 100% Book Built Issue IPO

- Face Value: Equity Shares of Rs. 10

- Issue Size: Rs. 1,272.20 Crore

- Issue Price Range: Rs. 700 – Rs. 765 per share

- Minimum Shares: 15 Shares and in multiple of 15 there-of

- Minimum Amount: Rs. 10,500

- Listing: BSE and NSE

- Download Indigo IPO Prospects at this link

Company’s Promoters:

The promoters of the company are Mr Rahul Bhatia, Mr Rakesh Gangwal and InterGlobe Enterprises & Acquire Services.

Objectives of the IPO:

The Issue comprises the Fresh Issue and Offer for Sale:

Objects of the Offer for Sale (OFS):

The proceeds from OFS (net of Issue related expenses incurred by the Selling Shareholders) will go to the Selling Shareholders and the Company will not receive any proceeds except reimbursement of Issue expenses incurred by the Company on behalf of the Selling Shareholders.

Objects of the Fresh Issue

Company proposes to utilize the funds which are being raised through the Fresh Issue for the following objects:

- Retirement of certain outstanding lease liabilities

- Acquisition of aircraft;

- Purchase of ground support equipment for airline operations; and

- To receive the benefits of listing of the Equity Shares on the Stock Exchanges.

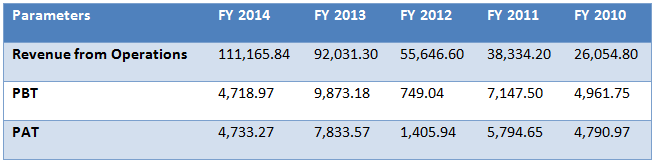

A close look on the Financials of the Company:

This is one of the few companies in the Indian aviation market which has made profits in the last five years. For the year ended March 2015, the carrier recorded a net profit of Rs 1,295.58 crore on revenues of Rs 14,309.14 crore. This is a big plus as not many people are able to make money in this sector.

IndiGo posted a net profit of Rs 640.44 in last quarter but its net worth was negative -139.39 Crore which is not a good sign.

*Numbers in Millions

Reasons to Invest in Indigo IPO:

- Indigo has largest market share in aviation markets in India.

- Indigo maintains consistent execution of the low-cost carrier business model.

- Cost advantage.

- Strong brand recognition

- Company maintained consistent profitability and strong cash flow generation, balance sheet and liquidity position.

Reasons to NOT to Invest in Indigo IPO:

- Constraints in growing in the domestic networks

- Constraints in increasing flight frequencies in a profitable manner

- Inability to acquire additional licenses and traffic rights

- Delay in accruing flight slots on financially viable terms

- Greater reliability on crude prices

Investment Strategy:

The Indigo IPO is estimated to be valued at 3200 crore and with the PAT of Rs. 1300 crore at Rs. 700 price band the PE comes out to be 24 whereas industry average PE is around 6. Paying such a high price in this uncertain sector does not make sense and even how long they will be able to sustain these profit is also a big question. I would personally rather suggest staying away from the IndiGo IPO.

Disclaimer:

Investing in this IPO does not interest me much. The idea of enlisting positive and negative sides to investor in this articles is to create awareness and education about this IPO. Please consult your investment adviser before you invest in such high risk investment option.

This aviation industry amazes me.Why in spite of day in and day out loss,they keep on announcing reduced rates or is there a catch?Why so many players in the arena none of them making money?But you go to any air port at any time it is more crowded than a railway Station or a Bus stand?

KEEP OFF the IPO