The Stand Up India outline, propelled on April 5, makes sure that SC/ST & women entrepreneurs have a fair chance at setting up their own small companies. The plan enables loans from Rs 10 lakh to Rs 1 crore for these segments of the population.

Our Prime Minister Narendra Modi had threw the Start-Up India scheme in January 2016, which provided new businesspersons an opportunity at making it big. Under this scheme, entrepreneurs could get loans from the banks to boost their businesses. Now on the same line, a new plan that has been launched on April 5 has shifted its focus to SC/ST & women entrepreneurs, to encourage inclusivity.

The Stand Up India scheme offers loans to the SC/ST & women entrepreneurs. The loans range from Rs 10 lakh to Rs 1 crore. As per the government, these are segments of the population that are every so often deprived or under-served but they are fast and up-coming. The scheme benefits them out by smoothing loans for non-farm sector entrepreneurship.

“It is within everyone’s grasp to be a CEO.” — Martha Stewart

The StandUp India plan outlines:

- Credits for SC/ST & women Entrepreneurs: In India, SC/ST & women entrepreneurs find it hard to get capital for their business. Global Entrepreneurship and Development Institute (GEDI) has issued a global ranking that sums up as how female entrepreneurs charge across the world. India found its ranking amongst last five out of the 30 countries that were studied. It identified that nearly 73% SC/ST & women entrepreneurs could not get funding from Venture Capitalists (VC). A study carried out in Karnataka revealed that nearly 90% SC/ST & women had to rely on their own funding, whereas 68% found it hard-hitting to even receive bank loans. This all is planned to change as the Start Up India scheme goes into action.

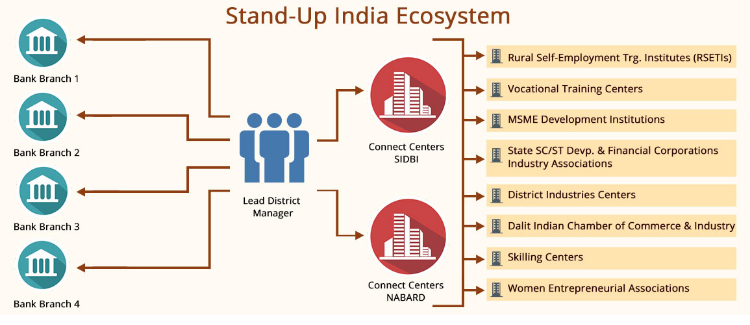

- Refinancing Opportunities: The scheme benefits not only those who are in the early phases of their entrepreneurial policies, but to those as well who have already set up their business but come under the startup category. In this policy, the government has unlocked refinancing choices via Small Industries Development Bank of India (SIDBI), at an initial amount of Rs 10,000 crore. Accompanied by it, a quantity (principal amount) of Rs 5000 crore would be shaped, to make sure credit guarantee via the National Credit Guarantee Trustee Company. In addition to that there is a composite loan, they will also be equipped with a debit card.

- Sustenance and Information: A study indicates that about 54% SC/ST & women have no idea what a business in its initial phase should work like or how to slog on problem resolving. About 58% SC/ST & women require education for entrepreneurial assets and practices. Nevertheless, requirements of the scheme also contains backing for both SC/ST & women borrowers, all the way from pre-loan phase to operating phase. Moreover training the SC/ST & women with bank rules and terms, they will also be made knowledgeable about cataloguing online and how to use e-markets, and entrepreneurial tactics. For facilitating all these, the government has set up a website for Stand Up India.

- Extensive Scope for Concentrated Profit: Whereas self-employed SC/ST & women laboring in few sectors like physical labor or street hawking, has amplified to almost 1 crore between year 2000 and 2010, the number of SC/ST & women in greater income entrepreneurship is still a bit low. To upsurge this number, the purpose of the policy is to get at least two entrepreneurial ventures ongoing in every bank’s branch in India. The Stand Up India scheme is projected to profit nearly 250,000 prospective debtors.

- Connect Centres made Accesible: To meet the budding demand of the businesses, Stand Up Connect Centres are recognized at the administrative center of SIDBI and National Bank for Agriculture and Rural Development (NABARD). With country-wide existence of more than 15 local offices and 84 divisions obliging more than 600 bunches, the reach of SIDBI is huge.