Key Profit & Loss (P&L) Statement Highlights

- Net Profit of INR 8 Crores in Q1FY17; y-o-y growth of 32.8%

- Total Net Income of INR 2,217.1 Crores in Q1FY17 y-o-y growth of 1%

- Net Interest Income of INR 1,316.6 Crores for Q1FY17; y-o-y growth of 2% on back of growth in Advances & CASA. NIM expanded to 3.4% in Q1FY17 from 3.3% a year ago

- RoA stands at 7%, RoE at 20.7% for Q1FY17

- Book Value at INR2 per share as on June 30, 2016

Key Balance Sheet Highlights

- Y-o-Y growth in CASA of0%; CASA Ratio improves to 29.6% from 23.4% a year ago, 6.2% improvement in one year. SA deposits posted robust growth of 81.6% y-o-y

- CASA+Retail FDs as % of Total Deposits stands at a healthy 3% as at June 30, 2016

- Advances grew by 0% y-o-y to INR 1,05,942.0 Crores as at June 30, 2016

- Total Capital Adequacy as per Basel III is robust at 5% with Tier I ratio at 10.3% (including profits and excluding prorated dividend)

Total Capital Funds at INR 22,394.3 Crores as of June 30, 2016

Key Asset Quality Highlights

- Credit Costs at 15 bps for Q1FY17

- Gross Non Performing Advances (GNPA) at 79% and Net Non Performing Advances stable at (NNPA) at 0.29% as at June 30, 2016

- Provision Coverage Ratio (PCR) stands at 2% as at June 30, 2016

- Standard Restructured Advances as a proportion of Gross Advances at 49% (INR 522.9 Crores) as at June 30, 2016, down from 0.71% (INR 567.1 Crores) as at June 30, 2015. No additional restructuring done during the quarter

- Security Receipts (SRs) stand at 19% (INR 199.4 Crores) of Gross Advances as at June 30, 2016. There has been no sale to ARCs during the quarter

- Standard SDR Advances at03% (INR 34.3 Crores) of Gross Advances as at June 30, 2016 from single SDR account undertaken during the quarter

- Nil 5:25 refinancing during Q1FY17

Financial Highlights from Q1FY17 Results:

| Profit & Loss Statement Highlights | |||||

| (` in Crore ) | Q1FY17 | Q1FY16 | Growth % (y-o-y) | Q4FY16 | Growth % (q-o-q) |

| Net Interest Income | 1,316.6 | 1,059.8 | 24.2% | 1,241.4 | 6.1% |

| Non Interest Income | 900.5 | 545.2 | 65.2% | 802.8 | 12.2% |

| Total Net Income | 2,217.1 | 1,605.0 | 38.1% | 2,044.2 | 8.5% |

| Operating Profit | 1,306.8 | 908.3 | 43.9% | 1,225.5 | 6.6% |

| Provision | 206.6 | 98.0 | 110.9% | 186.5 | 10.8% |

| Profit after Tax | 731.8 | 551.2 | 32.8% | 702.1 | 4.2% |

| Basic EPS (Rs.) | 17.4 | 13.2 | 31.8% | 16.7 | 4.0% |

| Key P & L Ratios | |||||

| Q1FY17 | Q1FY16 | ||||

| Return on Assets | 1.7% | 1.6% | |||

| Return on Equity | 20.7% | 18.4% | |||

| NIM | 3.4% | 3.3% | |||

| Cost to Income Ratio | 41.1% | 43.4% | |||

| Non Interest Income to Total Income | 40.6% | 34.0% | |||

| Balance Sheet Highlights | |||||

| (` in Crore ) | 30-Jun-16 | 30-Jun-15 | Growth %

(y-o-y) |

31-Mar-16 | Growth % (q-o-q) |

| Advances | 105,942.0 | 79,665.6 | 33.0% | 98,209.9 | 7.9% |

| Deposits | 122,581.1 | 95,315.9 | 28.6% | 111,719.5 | 9.7% |

| CASA | 36,288.3 | 22,267.7 | 63.0% | 31,342.8 | 15.8% |

| Shareholders’ funds | 14,536.9 | 12,239.7 | 18.8% | 13,786.6 | 5.4% |

| Total Capital Funds* | 22,394.3 | 16,910.4 | 32.4% | 21,874.4 | 2.4% |

| Total Balance Sheet | 177,228.9 | 139,037.1 | 27.5% | 165,263.4 | 7.2% |

| Key Balance Sheet Ratios | |||||

| Capital Adequacy (Basel III)* | 15.5% | 15.0% | 16.5% | ||

| Tier I Ratio (Basel III)* | 10.3% | 10.9% | 10.7% | ||

| Book Value (`) | 345.2 | 292.7 | 327.8 | ||

| Gross NPA | 0.79% (` 845 Cr) | 0.46% | 0.76% | ||

| Net NPA | 0.29% (` 302 Cr) | 0.13% | 0.29% | ||

| Provision Coverage Ratio | 64.2% | 71.0% | 62.0% | ||

| Restructured Advances % | 0.49% | 0.71% | 0.53% | ||

| Security Receipts (Net) % | 0.19% | 0.28% | 0.20% | ||

| Credit Costs (in bps) | 15 | 6 | 16 | ||

*including profit, excluding prorated dividend

Mumbai, July 27, 2016: The Board of Directors of YES BANK Ltd. took on record the Q1FY17 results at its meeting held in Mumbai today.

Commenting on the results and financial performance, Mr. Rana Kapoor, Managing Director & CEO, YES BANK said, “YES BANK has delivered another highly satisfactory quarter of financial performance reflected in strong & quality growth, sustained profitability and continued resilience in asset quality.

The Bank continues to witness a robust CASA growth with the CASA ratio improving to a healthy 29.6% from 23.4% a year ago demonstrating significant momentum in the underlying Retail franchise platforms, as well as ongoing mandate in several corporate relationship groups. Further, YES BANK has received an in-principle approval from the Securities & Exchange Board of India (SEBI) to setup an Asset Management Company (AMC) which will further deepen our value proposition for our retail customers.

Given the improving macroeconomic environment along with stable Asset quality and accelerating Retail franchise, the Bank is well poised to capture Market share across Retail and Corporate segments at an enhanced pace.”

Q1FY17 Performance highlights

Profit & Loss Account

- Net Interest Income (NII): NII for Q1FY17 increased by 24.2% y-o-y to INR 1,316.6 Crores on account of strong growth in advances and CASA deposits. Net interest Margin (NIM) at 3.4% for Q1FY17 up from 3.3% for Q1FY16.

- Non Interest Income: Non Interest Income increased by 65.2% y-o-y to INR 5 Crores in Q1FY17.

- Total Net Income: Total Net Income increased by 38.1% y-o-y to INR 2,217.1 Crores in Q1FY17.

- Operating and Net profit: Operating profit for Q1FY17 increased by 43.9% y-o-y to INR 1,306.8 Net Profit in Q1FY17 was up 32.8% y-o-y to INR 731.8 Crores.

- Shareholders’ Returns: The Bank delivered RoA of 7% and RoE of 20.7% for Q1FY17.

Balance Sheet

- Deposits: Total Deposits grew by 6% y-o-y to INR 1,22,581.1 Crores as at June 30, 2016. The Bank’s Total Assets grew by 27.5% y-o-y to INR 1,77,228.9 Crores as at June 30, 2016. The Bank’s CD ratio stood at 86.4% as at June 30, 2016.

Current and Savings Account (CASA) deposits grew by 63.0% y-o-y to INR 36,288.3 Crores increasing the CASA ratio to 29.6% as at June 30, 2016 up from 23.4% as at June 30, 2015. Further, SA deposits grew by 81.6% y-o-y to INR 25,186.5 Crores from INR 13,867.4 Crores as at June 30, 2015.

- Advances: Total Advances grew by 0% y-o-y to INR 105,942.0 Crores as at June 30, 2016. Corporate Banking accounted for 67.5% of the Advances portfolio, while Retail & Business Banking (MSME) constituted 32.5%.

| Business Segment | As on Jun 31, 2016 | As on Jun 30, 2015 |

| A) Corporate Banking | 67.5% | 68.0% |

| (8 segmental relationship groups) | ||

| B) Retail & Business Banking | 32.5% | 32.0% |

| of which: | ||

| i) Business Banking (Medium Enterprises) | 11.0% | 14.1% |

| ii) Micro & Small Enterprises | 12.1% | 10.6% |

| iii) Consumer Banking (Urban and Rural) | 9.4% | 7.3% |

| Total | 100.0% | 100.0% |

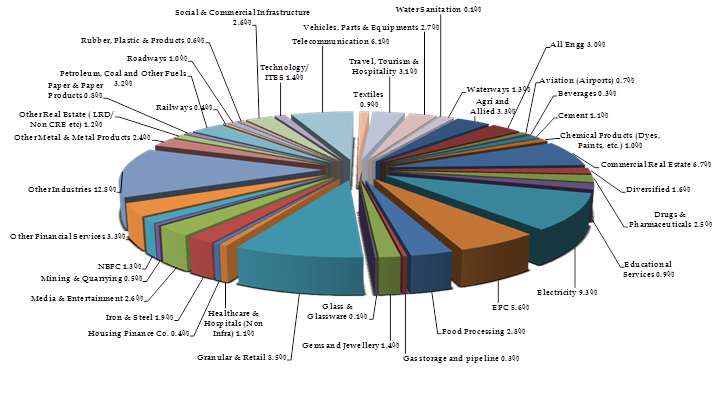

- Sectoral Distribution:

Overall portfolio is well distributed with significant deployment in YES BANK focused knowledge sectors where the Bank has developed considerable sectoral expertise with specialized Relationship Managers, Product Managers and Risk Managers.

- Sensitive sector disclosures:

| Sector/ Rating* | % of Total Exposure |

| (A) Electricity | 9.3 % |

| AAA/AA rated investments | 1.0 % |

| T&D | 1.5 % |

| Renewable Exposures(Green-Financing) | 2.8% of which 2.2% is operational |

| Non-Renewable | 4.0% (all operational) |

| Exposure to SEBs | Nil |

| (B) Iron & Steel | 1.9 % |

| A or above rated | 1.3 % |

| (C) EPC | 5.6 % |

| A or above rated | 3.8 % |

*Based on Internal ratings mapped to external ratings

All three sectors showing steady improvement in economic conditions driven by Government of India policy interventions.

- Asset Quality

Bank continues to show resilience on all Asset Quality parameters:

- NPA – Credit Costs at 15 bps for Q1FY17

Gross Non Performing Advances (GNPA) as a proportion of Gross Advances was at 0.79%

(INR 844.6 Crores) while Net Non Performing Advances (NNPA) as a proportion of Net advances was stable at 0.29% (INR 302.4 Crores) as at June 30, 2016. Bank’s specific loan loss Provision Coverage was at 64.2% as at June 30, 2016.

- Standard Restructured at 49% (down from 0.71% y-o-y)

No additional restructuring during the quarter.

The total Standard Restructured Advances as a proportion of Gross Advances was at 0.49%

(INR 522.9 Crores) as at June 30, 2016, down from 0.71% (INR 567.1 Crores) as at June 30, 2015.

The restructured loans have been performing in line with expectations and the Bank does not anticipate any material slippages in this book.

- Security Receipts at 0.19% (down from 0.28% y-o-y)

No sale to ARC during the quarter.

Net Security Receipts (SRs) stood at 0.19% of Gross Advances (INR 199.4 Crores, comprising 10 borrowers) as on June 30, 2016, down from INR 221.0 Crores (0.28% of Gross Advances) as on June 30, 2015.

- Standard SDR Advance – Single SDR of only 0.03% outstanding exposure

During the quarter bank had one instance of Standard asset Strategic Debt Restructuring with an outstanding exposure of only 0.03% (INR 34.3 Crores) to Gross Advances as on June 30, 2016.

- 5:25 Refinancing – ‘No 5:25 Refinancing during the quarter’

- Rating Profile – Bank’s Corporate Exposures continue to remain well rated with over 75% portfolio rated ‘A’ or better. (Based on Internal ratings mapped to external ratings)

- Capital Funds (including profits, excluding prorated dividend): As per Basel III, Tier I Capital of

INR 14,825.6 Crores stood at 3%, and total CRAR stood at 15.5% as at June 30, 2016. Total Capital funds are at INR 22,394.3 Crores as at June 30, 2016.

Risk Weighted Assets stood at INR 1,44,252.6 Crores as at June 30, 2016. RWA to Total Assets at 81.4% as on June 30, 2016 against 81.0% as on June 30, 2015.

- Liquidity Coverage Ratio: During Q1FY17, the Bank continued with the LCR maintenance at well above 70% regulatory requirement with monthly average Liquidity Coverage ratio of 1%, reflecting a healthy liquidity position.

YES Bank Credit Rating Profile

- Bank continues to maintain strong credit ratings across International and Domestic Rating agencies.

- Moody’s has reaffirmed Long-term international rating of Baa3 which is in line with the Sovereign Rating of India.

- Domestic Rating agencies (ICRA & CARE) have Long-Term rating of AA+ for the Bank’s Basel III compliant Tier II instruments as well as for Infrastructure Bonds.

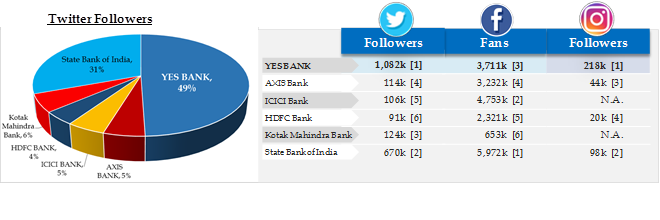

Social Media

- According to the recent ranking by The Financial Brand publication, YES BANK is ranked amongst the Top 5 Global Bank Brands on Social Media.

- As per the same report, YES BANK is the Highest followed Global Bank Brand on Twitter with over 1 million followers, and also the Fastest Growing Global Bank Brand on Facebook with more than 3.5 million Page Likes.

- YES BANK is also the Highest Followed Bank Brand on Instagram in India with over 2 lakh followers.

- YES BANK is the 1st Bank in India to launch ‘Facebook at Work’ to its workforce & have achieved 100% registration across over 16,000 employees.

| Note: Data as on July 25, 2016 |

Digital Banking

YES Bank continues investing significantly in new-age mediums and digital technologies to achieve a heightened customer engagement and experience. Some of the Bank’s key digital initiatives revolutionizing payments ecosphere are as follows:

- YES Money program: One of the largest Domestic Remittance program encompassing over 5.1 million customers with a cumulative transaction throughput of INR 13,000 Crores.

- Over 4 million YES Bank co-branded Virtual prepaid Cards issued on the MasterCard platform since launch in January 2016, the ‘largest virtual prepaid card’ program in the world.

- Over 34 million YES Bank powered Freecharge Wallets issued since launch in September 2015.

- Launched ‘QR Code’ based Proximity Payments in collaboration with Click & Pay.

Expansion & Knowledge Initiatives

- Total headcount stands at 16,421 as at June 30, 2016, an increase of 1,421 employees in the quarter and 4,878 incremental employees since June 30. 2015.

- The Bank’s branch network stood at 900 branches as on June 30, 2016, an addition of 40 branches in the quarter. Total ATM network stands at 1,680 as on June 30, 2016, of which 428 are Bunch Note Acceptors (BNA)/Recyclers.

- YES BANK has received RBI approval post approval from the CCEA (Govt. of India) to raise its Foreign Investment Limit to 74%. This has made YES BANK the FIRST Bank in India to have an operational fully fungible composite foreign ownership limit of 74%

- YES BANK has received an in-principle approval from the Securities & Exchange Board of India (SEBI) to sponsor a Mutual Fund and to setup an Asset Management Company (AMC), and a Trustee Company. The AMC and the Trust Company shall be set up as wholly owned subsidiaries of YES BANK Limited. This is further to the Reserve Bank of India (RBI) approval for AMC granted to YES BANK in October 2015

- YES BANK has announced commitment of INR 250 Crores towards two key focus areas of livelihood and water security, and environment sustainability by 2020 through its focused and intensified CSR and Sustainability action.

- YES BANK has pledged GBP 1 Millionto the London School of Economics and Political Science (LSE) to support the IG Patel Chair– named in honour of the former Governor of the Reserve Bank of India and former Director of LSE. The funding from YES BANK will also support the work of the LSE India Observatory, which was established in 2007 to continue to develop and enhance research and programmes related to India’s economy, politics and society with a specific focus on Climate Change and Sustainability.

Awards & Recognitions

- YES Bank has been adjudged as Asia’s Best Bank for Corporate Social Responsibility at the Euromoney Excellence Awards 2016 held in Hong Kong.

- YES BANK won 2 awards at The Asset Triple A Asia Infrastructure Awards 2016, Hong Kong:

- Best Energy/Renewable Energy Deal – Solar, India for Porbandar Solar Power ` 126 Crores non-convertible debentures, in which YES BANK acted as sole underwriter.

- Best Green Bond Facility within highly commended category in India, for IFC’s ` 315 Crores green infrastructure bonds on the back of YES BANK’s domestic green bond issuance

- YES BANK made its maiden entry into the Forbes Global 2000 List of World’s Top Companies 2016. YES BANK was the youngest Indian Company on the Forbes 2000 List and also one of the youngest Banks in the World on this prestigious list.

- YES BANK was recognized among India’s Best BFSI Brands by Economic Times Best BFSI Brands 2016

- YES BANK received multiple awards at The Asian Banker Awards 2016:

- Best Trade Finance Bank in India

- Best Corporate Payments Project in India for API Banking implementation for Snapdeal, one of India’s leading e-commerce players

- YES BANK received the Best Bank (midsized) Award for Cyber Defence from RBI Governor Dr. Raghuram Rajan at the IDRBT Banking Technology Excellence Awards 2016

- Rana Kapoor, MD&CEO was felicitated by the London Business School (LBS) India Business Forum 2016 for Exemplary Contribution to Entrepreneurship & Innovation

The Press Conference of YES Bank’s results will commence at 12:45 pm and we have invited leading business news channels, newswires and publications to cover the conference as well as interviews of YES Bank’s management team.

- YES Bank’s analyst conference call can be heard at following link, post 10 pm:

https://www.yesbank.in/investor-relations/financial-results/2016-2017-q1.html

ABOUT YES BANK

YES BANK, India’s fifth largest private sector Bank, is the outcome of the professional & entrepreneurial commitment of its Founder Rana Kapoor and his top management team, to establish a high quality, customer centric, service driven, private Indian Bank catering to the Future Businesses of India. YES BANK has adopted international best practices, the highest standards of service quality and operational excellence, and offers comprehensive banking and financial solutions to all its valued customers.

YES BANK has a knowledge driven approach to banking, and a superior customer experience for its retail, corporate and commercial banking clients. YES BANK is steadily evolving its HR character as the Professionals’ Bank of India, with the unrelenting vision of “Building the Finest Quality Bank of the World in India” by 2020.

For further information, please contact:

| Jitesh Patel

YES BANK Ph.: + 91 22 3347 9753, Cell : +91 9820813570 |

Delna Irani

Adfactors PR Ph.: +91 98206 60467 |