Life Insurance is like a commodity which every one has or likely to have it. It has become a necessity of today’s time as we live in a uncertain world where any thing can happen any time and to compensate the bad time for our dependents we usually go and buy life insurance.

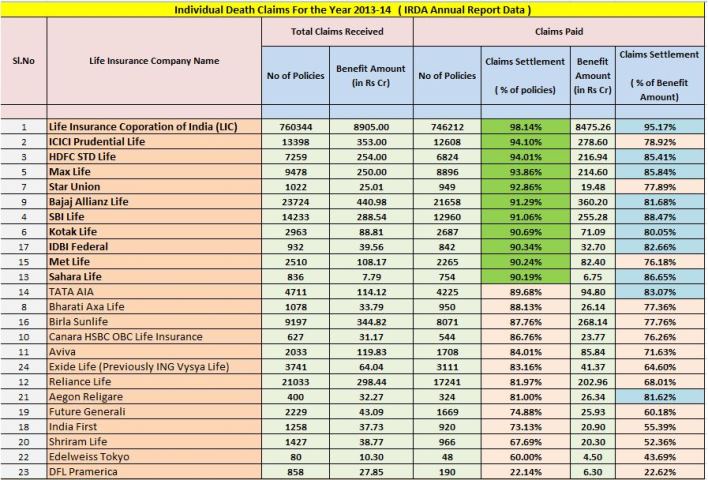

Usually people have tendency to buy a life insurance on behalf of their claim settlement ratio and premium amount. If they find premium is lower and over all claim settlement ratio is good they go and buy that life insurance. Now lets have a look on some data of claim settlement of different insurance companies:

By looking at above table a normal person will always like to go with the green marked companies as they have higher claim settlement ratio. But I would like to some points over here which might open your eyes and change the complete scenario:

- The claims settlement ratio mentioned above does not talk about the type of policies against which the claim is raised or paid.

- New Life Insurance Companies like Edelweiss Tokyo will generally have Low Claim Settlement Ratios. It launched in FY12.

- Life insurance companies have a very high rate of rejection in the ‘early claims’; Therefore if claim is made within 2 years after taking the policy, then the chances are far higher of its getting rejected. As you can see in above list Edelweiss Tokio, India First, Canara HSBC, Aegon Religare has lower claim settlement ratio as they started operation in last five/six years.

- First three years claim settlement: The claim ratio of most company is in the range of 50% to 60%. It’s only later as years pass by more claims come in and hence the claim ratio is higher.

Also Read: 4 Points to Remember While Buying Term Plan

The older companies usually see more of non-early claims therefore their overall rejection ratio seems lower. As insurers are not allowed to reject claims citing non-disclosure of facts if the policy is in force for more than three years. So, you can understand the older companies have high number of policy issued in the market as they are working for last 10-20 years in the market and they have to settle the claims if the policy is 3 year older it directly increases their settlement ratio. In opposite to this newer companies face many early claim filing, typically within 3 years of buying the policy and these companies as usual process investigate thoroughly to rule out any fraud and non-disclosure of facts. Due to this, typically, newer insurance companies have a lower claims settlement ratio as they have a higher percentage of early claims. As these new companies face more chances of fraud, customer misrepresentation and medical non-disclosure in early claim cases.

Also Read: 6 Points to Remember While Buying Health Insurance

Lets see it by taking an example: Edelweiss Tokio Life Insurance Co. Ltd has claims settlement ratio of 60% and all of its claims are early claims (company was launched in FY12). These private new player always come with other attractive benefits as they are aware that customer look for the claim settlement ratio. After establishing into the market and after 8-10 years, their claim settlement ratio will also be on 90% + range. Edelweiss Tokio life mylife+ has below advantage on their policy:

- Cover up to the age of 80

- Flexible payout: Lumpsum, monthly or combination

- Life cover at only Rs. 4950 P.A. for a healthy 25 year old male non-smoker for a policy of 25 years.

Therefore always look for other factors also while buying the insurance not only the claim settlement ratio as newer companies giving good additional benefit. These older companies will always lure you on the behalf of the claim settlement ratio only and charge you higher premium on the basis of that.