Retirement is the age which changes many things in one’s life. At this point of time we stop working and start enjoying with our family, wife and our old age. Yes, we also stop getting salary; which we were getting for last 35-40 years.We stop fighting for promotions or hikes. But surely most of us manage to keep up with our lives because we know one day this hectic life will come to an end and it is this distant end in the horizon that manages to keep us on our toes.

Why should we wait for retirement when we get old???

Why can’t we retire young; so we can enjoy our life in younger age?

Surely very less people are able to achieve the same. To retire at any age means becoming financially free; You need enough money to sustain your self for the rest of your life then why many people fail in this? Why we are not able to retire rich at a younger age or even older age also? What stops most of us from retiring early? Let us have a look.

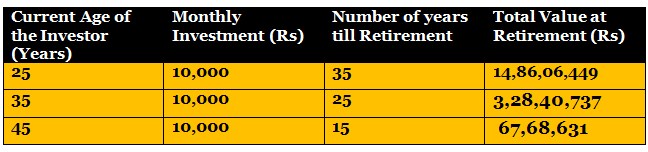

You Didn’t Start Early: We normally think of life as a very short period. We always stay involved in achieving our short term goals or wishes. We never focus on the retirement corpus. We believe its very far and we would be able to live freely and happily in our retirement days. In 40’s we get serious about retirement and think that its approaching now; then we start contributing to our retirement corpus. But at this stage our risk taking ability decreases and we usually invest in safe options which gives us very less return. Then in 50’s when our body and mind wants to retire but we can’t as we don’t have enough fund in our retirement corpus to create a monthly fixed payment for our expenses. Hence, the only option is to keep working and investing till the corpus reaches that magic number. It could still take as long as ten or fifteen years.

From the table above it is clear which investor will be the winner in creating an early retirement corpus. One who delays his retirement planning by ten or twenty odd years and now the same is delaying his retirement by ten to fifteen years. So if you are still wondering whether you should start retirement planning or not. Start planning! You delay the planning your planning delays you. Simple! Heard of the famous quote,

‘what goes around comes around back again’

Not a Disciplined Investor: Discipline is must for the investors. Investments are not so much about the amounts you invest rather about how disciplined you are. The level of discipline you show reflects upon your willingness to invest. Usually investors lose interest in the investment in the middle because they lose their dream for what they were investing. It is advised to have a financial planner with you so that he keeps you guided.

Discipline is also reflected by the attitude with which you are investing. Do you put aside your investment amount and then spend? Or investments play a secondary role to be put aside once you have spent? If it is the first one; perhaps you can hope for early retirement. If it is the second one; then maybe you should start thinking if you will even retire at 60. Retirement investments have to be made a priority whether you plan to retire at 50 or 60. A disciplined investor will always put aside the investing money and then budget the rest for savings.

Too Much or Too Little Diversification: Both these things are bad. Too much diversification reduces your return and also it makes a cumbersome task to manage them whereas too little diversification increases the risk for the person. So, one needs to identify his or her own needs and discuss the same with his or her financial planner and then prepare the complete list where one should invest and keep investing in them. From time to time he needs to check on those investment returns. Like in mutual fund one can check once in a year for the returns and see if the returns are above or at what his or her minimum return requirement. If not then he can talk to his or her financial planner for help.

Returns from Various Investments:

Right diversification is mix of risk and return. According to one’s age risk and return can be adjusted and accordingly investment options must be selected.

Underestimating Inflation: Inflation is like a shark for your money, if you are underestimating this shark then you are making a big mistake. The present cost of a commodity is different from that of the future cost because of the inflation. Hence, the sum that is enough to manage your household expenses today will not be enough in the future. While determining the future cost of your corpus never underestimate the impact of inflation because it could land you in trouble. Big trouble!

From the above table one can easily see the present household expenses of one lakh is enough for now but it will certainly not be enough after 10 or 20 years from now on.

Conclusion: Retirement planning requires aggressive investment from an early age even if you want to retire at 60. Early retirement is not an impossible goal to achieve but it has to be made a priority for it to get fulfilled by the age of 45-50. A planning for early retirement should be done with the help of a financial adviser or retirement planner and should be reviewed yearly. So start early, start now while time is on your side and you may just finish early.