If you love reading books, then you must have been well aware of the book called – The Richest Man in Babylon, and the phrase that grabbed the readers’ attention was “Pay yourself first”. However, this simple statement has got a new definition into a profound personal finance rule by Robert Kiyosaki. In fact, Kiyosaki is his book – Rich Dad Poor Dad had tried to explain the significance and utility of paying self-first.

The question is – What makes “Pay Yourself First” so unique?” The answer lies in its simplicity that clearly states to always pay yourself first formerly and then spend a dime anywhere else. Let us try to understand how to best implement this strategy.

To start with, the most common perception that most of us carry or have in our mind is that getting rich is never an easy game. Right! How often you have heard your friends, neighbours or even your relatives’ saying- “Getting rich is lot more difficult.” So, why not you give this concept – PAY YOURSELF FIRST a try. If you succeed, then it is a gain for you, and if not, you would still take some great lessons in terms of money management.

Initially, I too had doubts about implementing this concept, but I followed it and guess what, it worked. This is a simple rule, and one can easily follow it and see its benefits. As Kiyosaki says, following pay yourself first rule is more like a self-discipline and relates with how to utilize the “not spent money”. Mr. Robert Kiyosaki has tried to explain this entire concept in a very innovative way.

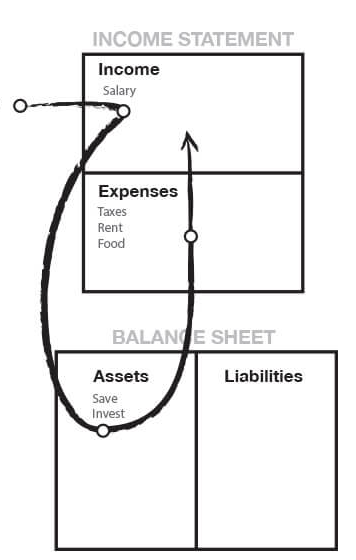

He had shared two stories via diagram, and here is the first story:

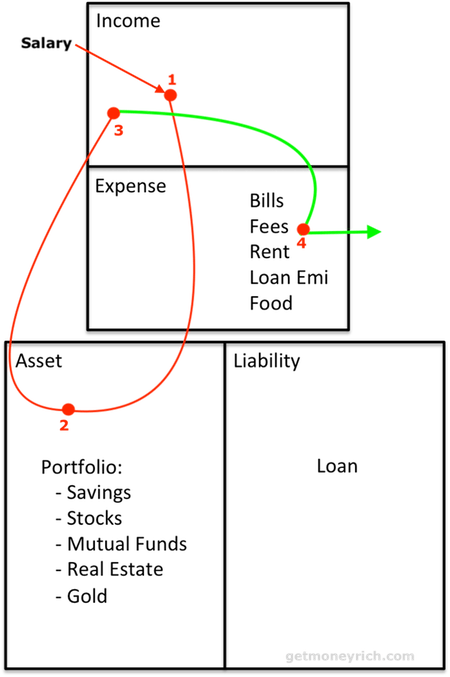

Here is the second story:

Now, if you carefully try to study the diagram, then you could easily pick the key lessons of cash flow management.

The first diagram clearly depicts the smart actions performed by those who pay themselves first. Every month these individuals first assign money to their asset column right before they pay others or wage their monthly expenses. However, the second diagram illustrates the actions performed by different set of individuals who pay everyone else before they pay themselves. In fact, these individuals allot money to their expenses column and after that invest or think about investing with whatever is left over—which is nothing or much below the expectation.

So, all that Mr.Robert Kiyosaki is trying to emphasize is the real significance of the power of cash flow. A careful study of the second diagram could easily give you an idea about where you can get wrong if you don’t pay yourself first. In fact, you would really find strange to know that most of the people throughout their life work hard and ultimately start seeking government support like Social Security when they find difficulty to work longer. The real problem is they pay themselves last.

It is very common tendency of every next individual to have a plan to spend. We all are natural spenders of money, and consequently our natural money management drives are weak.

Kiyosaki is asking us to do is exactly the opposite. Do not spend. Do not pay your bills, fees, mortgage, dinning etc. In fact, he is asking you to “pay yourself first”. You might again be wondering – how to live the next month if we just completely ignore not to pay for our expenses. The answer, lies in the statement, “Pay yourself first is a method of saving”

Pay Yourself Fist – A Method of Saving

“Pay yourself first” concept is based upon the fact that money is exactly similar to water. As water can expand to fill the container of any shape in which it is placed, money too can help you gain more money if you try to calculate all your investments properly.

The phrase is referring to making a certain share of your paycheck paid to your retirement account. You could well invest the funds in a cash savings account. Paying yourself first must comprise of saving. In fact, you could tie these savings to goals – either instant objectives like buying a car, studying, re-investing it into your business etc. or long term goals such as retirement plan, planning for your children future, etc.

The benefit of ‘paying yourself first’ out of your regular pay checks is that you create a nest egg that helps you secure your future. In fact, when you put your future and financial goals first, you start avoiding rethinking of anything else. By paying yourself first, you can make sure the life you have is full of hope for the future.

How paying yourself first works

The strategy is simple, but yet powerful because:

- It puts saving first- When you keep telling yourself that you’re going to set money apart for yourself then you get into a habit of setting goals and saving money. After you get used to the idea, you can easily see that your savings in form of investment will start to accumulate.

- It’s automatic- Once you set up an automatic transfer, you stop replying on yourself to save money instead of spend it.

Kiyosaki insist to become financially independent. Let us once again have a look at the diagram explained below:

Mr. Kiyosaki is asking his readers to take the following steps:

- 1: Let your salary become YOUR income(so pay yourself first).

- 2: make use of your income to further grow your asset column (create an investment portfolio).

- 3: The Asset comprising of savings, stocks, could further help you in generating passive income.

- 4: Finally, after you have your passive income, then use it to pay all expenses(standard of living).

This is what Robert Kiyosaki anticipates to do with the reserved income. Let me elaborate more about “pay yourself first” concept and get a clear picture of its benefits:

Take another typical example of a person named: Vidyut Malhotra.

- Current Salary: Rs.50K/month. Average salary increment for next 11 years: 8% p.a.

- Yield of monthly income generating investment for next 11 years: 6.5%.

Now, consider Vidyut is investing his 100% salary to buy income generating asset. Let us view his passive grows right from the first year to eleventh year.

- 1st year – Passive income is 6% of salary income.

- 2nd year – Passive income is 12% of salary income.

- 3rd year – Passive income is 18% of salary income.

- .

- .

- 11th year – Passive income is 50% of salary income.

Now by the end of 11th year, Vidyut has not just made substantial passive income but has an asset worth one crore by the end of the 11th year. Can you provide any name of the individual who have an asset worth Rs.1 crore only at 11th year in job?

Paying yourself first works, and your future will thank you.

Conclusion on Paying self-first

Undoubtedly, initially you may find it difficult to accept this concept, as most of us are not used to not-spending money. Not-spending can be a bit difficult as we all have idle money (paid to self) in hand, however it is always better to lock the money (by investing). You must accept the fact that by paying self-first, we are earning not to spend, but to become financially independent.

Robert Kiyosaki has successfully concluded it effectively in his book:

Mr. Robert Kiyosaki has emphasized to never get fall into the trap of large debts. It is always better to keep your expenses always in check. You can spend on different things, but just try to ensure not to overspend on anything. It is good to stick to your budget, but also keep building your asset. In fact, you can set a goal where your passive income is 50% of your income from job. With every month as your investment portfolio gets bigger, your passive income too gets bigger.

Follow the practice of paying yourself first as it is the most effective concept to attain financial independence.

Hi, my wife and I are self employed. The question we have is is it gross or net income? For example, we are taking 10% of rental income and re investing it but Is that number before mortgages, taxes and insurance, or after expenses?