The systematic investment plan (SIP) as a concept has emerged as a popular investment avenue for investors investing their money into mutual funds. This can be seen from the fact that inflows through SIPs have progressively increased from around Rs 3,122 crore in April 2016 to Rs 8,022 crore as of December 2018, cumulating to a total of around Rs 1.80 lakh crore*. The popularity of the SIP as a product emerges from the various benefits it provides like;

- Monthly investment as low as 500

- Power of compounding

- Rupee cost averaging

- Removes hassle of timing the market

- Instills investment discipline

Savvy investors can leverage the benefits of SIP to reduce the burden of last-minute investments for tax savings by investing throughout the year in small sums, thus creating a winning combination to not only save tax but also create wealth over the long term.

Why wait for Tax Saving season to save Tax when you can SIP.

Did you know that SIP’s can be effectively used to plan your taxes through ELSS mf schemes? Instead of an annual outgo of Rs 1,50,000 into an ELSS Tax Saving scheme, you can start your SIP in ELSS and build your Tax Saving Investment systematically over the year. Thus giving you flexibility and creating an investing discipline.

Most importantly, by investing a small sum regularly with a SIP for a long period through the highs and lows of the market, you can stop worrying about timing the market and the volatility as you will average out your costs and thereby improve your returns from ELSS investments.

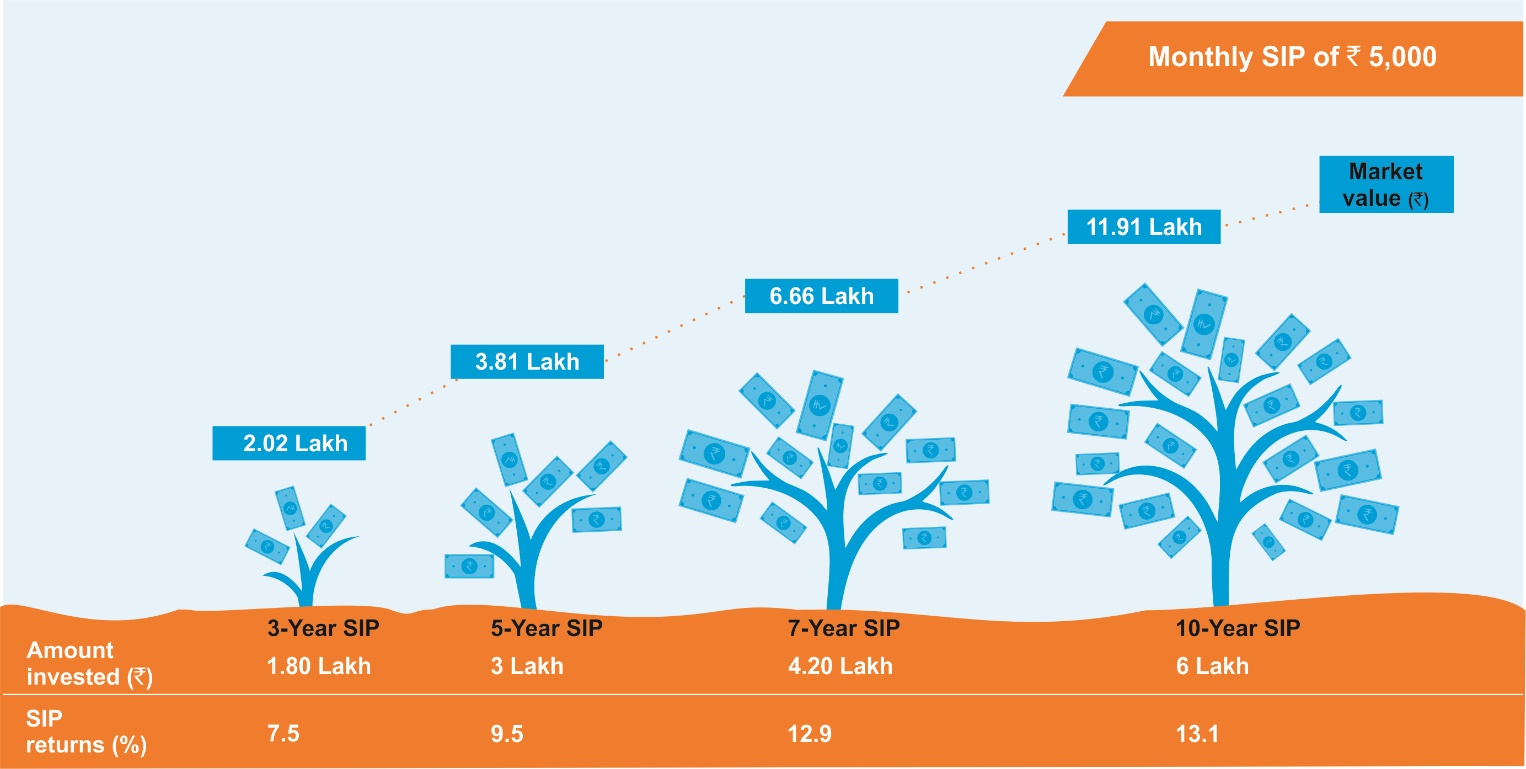

SIP in ELSS helps you save Tax and helps your money grow

ELSS is represented by asset weighted index created out of CRISIL-ranked ELSS funds. SIP returns are annualised

Data as of December 31, 2018

Source: CRISIL Research

So, go ahead and make tax-saving a year-round activity by doing a SIP in an ELSS fund instead of being burdened by a lump-sum payment in the last quarter of the financial year.

* Association of Mutual Funds in India (AMFI).

Disclaimer – CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of Data / Report. This Report is not a recommendation to invest / disinvest in any entity covered in the Report and no part of this report should be construed as an investment advice. CRISIL especially states that it has no financial liability whatsoever to the subscribers/ users/ transmitters/ distributors of this Report. CRISIL Research operates independently of, and does not have access to information obtained by CRISIL’s Ratings Division / CRISIL Risk and Infrastructure Solutions Limited (CRIS), which may, in their regular operations, obtain information of a confidential nature. The views expressed in this Report are that of CRISIL Research and not of CRISIL’s Ratings Division / CRIS. No part of this Report may be published / reproduced in any form without CRISIL’s prior written approval.