Indians’ penchant for debt investment is quite well known. About 59%* of financial savings is parked in bank fixed deposits (FDs). But take a look at the investment universe. It is huge and flooded with other debt instruments which can be used to generate returns.

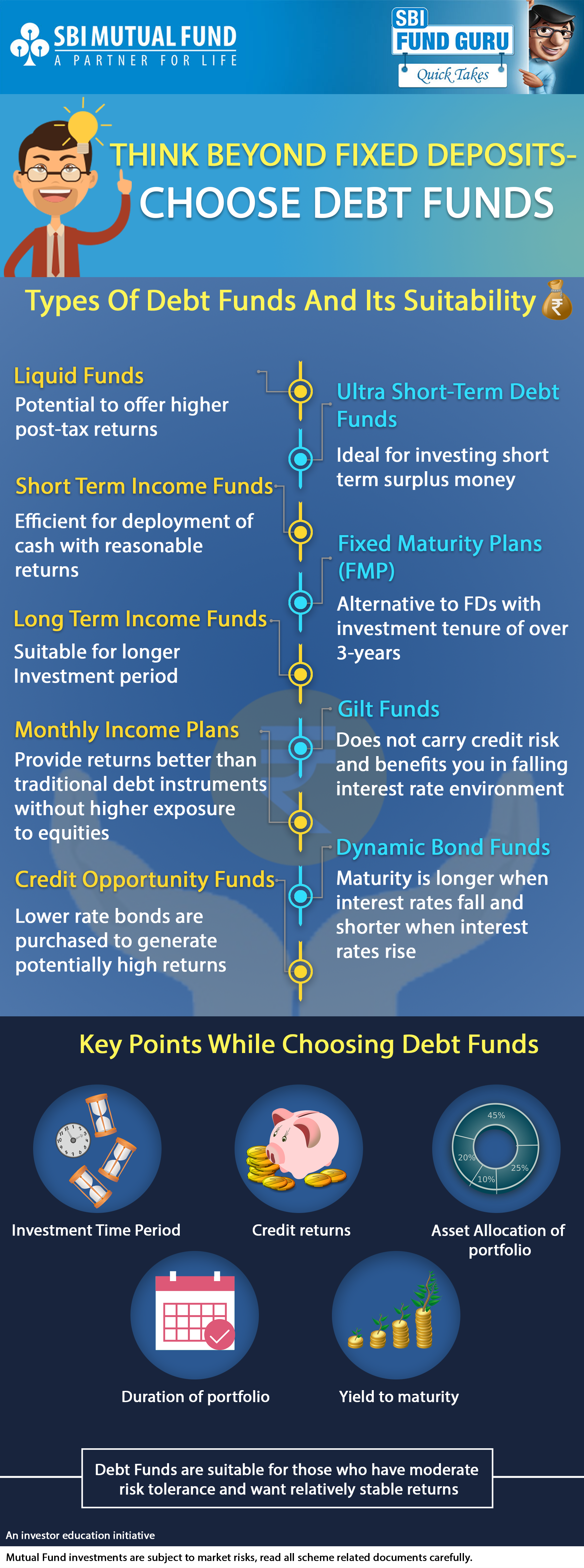

Debt mutual funds are professionally managed mutual fund schemes that enable investors to take exposure to fixed income instruments. The underlying portfolio of a debt mutual fund scheme comprises securities of varying instruments (certificates of deposit or CDs, government security or G-secs, commercial papers or CPs, bonds, Treasury bills, etc.) as per asset allocation and investment objectives.

Benefits of Debt Funds:

- Funds managed by professionals

- Reduces risk and enables you to take advantage of differing market environments

- Provide better schemes to manage different risk profiles through short term liquid funds

- Economically efficient

- Reduces tax liability